Moving can be expensive.

You probably already knew this, or you wouldn’t be perusing this article. We’re going to unpack all the need-to-know details on moving costs and how to make them affordable. So go ahead and (gently) toss your collection of worry stones into the nearest moving box.

How Much Does It Cost to Move?

In the US, local or regional moves could run you around $1,500 while long-distance moves might cost in the $5,000+ range. If your move crosses national borders — you’re probably looking at much bigger (and possibly different) moving expenses.

In the US, local or regional moves could run you around $1,500 while long-distance moves might cost in the $5,000+ range. If your move crosses national borders — you’re probably looking at much bigger (and possibly different) moving expenses.

These are just loose estimates, though. Many factors contribute to and influence how much you’ll need to budget for moving expenses. Each move is unique, so expect variations in the types and amounts of related spending.

Things that Impact Moving Expenses

These are just some of the variables that will affect your cost of moving:

These are just some of the variables that will affect your cost of moving:

- Distance — Moves of less than 100 miles are often based on hourly rates whereas longer-distance moves are generally flat-rate.

- Changing country of residence — Moving to a foreign destination can mean expenses related to visas, permitting, and more.

- Number of floors — Movers often charge more if stairs are involved.

- Size of move — Unsurprisingly, it typically costs less to move a junior-studio-sized load than a mansion-sized household.

- Items to be moved — It may be more costly to move awkward or delicate possessions. Special care or equipment may be needed to properly transport that baby grand piano, spindly antique bench, or set of neon signs you’ve amassed.

- Date and lead time for move — Certain months or seasons may cost more to move. Urgent or rush relocations may also incur extra charges.

- Whether or not you’re moving vehicles — There are costs associated with transferring your cars, whether you’re driving them yourself or using a shipping service. If you have recreational vehicles (e.g., campers, ATVs, jetskis, boats, etc.), you have to account for those as well.

- Whether or not you’re moving pets — This can impact how you move and necessitate additional tasks, which can translate to more money to move.

- Packing practices — Higher-quality and more extensive wrapping supplies and materials can add up.

- Deals — Coupons, sales, and special promos can knock down many moving expenses.

List of moving expenses

By no means exhaustive, here are some common moving expenses to ponder:

- Movers

- Moving supplies

- Travel (e.g., flights, hotels, rental cars, gas, food, etc.)

- Renovations or repairs

- Buying new furniture or other household items

- Fees and/or deposits charged by condos, apartments, or HOAs

- Cleaning services

- Yard or landscaping services

- Junk removal services

- Advanced activation of utilities and services

- Child, elder, and/or pet care services

- Settling-in costs

- Storage

- Services and memberships you forget to cancel at your former abode

- Permits for building, moving, or parking

- Insurance

- Damage or loss

Pro Tip: Use a Moving Cost Calculator to get a ballpark idea of how much your move may ring up at.

Loans to Help with Moving Costs — Why?

We can think of several main motivators for getting a loan to ease the burden of moving expenses. Perhaps one or more of these resonates with you?

Reason #1: You Don’t Have Enough Cash On Hand

We’ve established that moving is a big-ticket item, so to speak. It can also be a bit unpredictable, with new expenses popping up at the last minute (or mid-move!).

Given this scenario, it’s possible that you might not have enough liquid funds to pay the flood of regular and moving-related bills. Especially if you’ve had to plunk down a sizable chunk of change on a deposit or down payment.

This is completely understandable and relatable! Hence, a loan may be a good route for you to take.

Reason #2: It Could Be Cheaper Than Using Your Credit Cards

Assuming you still have the bandwidth to use your charge card — moves rack up the balances ever-so-swiftly — this could turn into a really expensive method of financing your move.

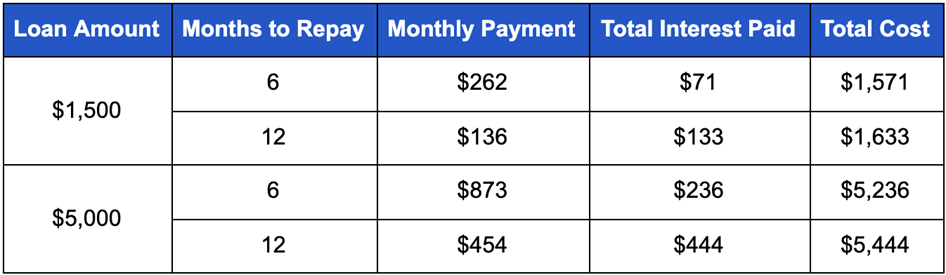

According to several sources, the current (May 2021) average interest rate for credit cards is hovering around 16%. If you don’t pay off your balance every month...well you can see how 16% of a lot is a lot more! For illustration, check out these examples based on the average move costs we mentioned above:

Sample Costs of Using Credit Card for Moving Expenses

Paying with plastic doesn’t always pay. Getting a loan to cover your moving expenses directly or as a means of consolidating and zeroing out your credit card balances may be worth it. Doing so may ultimately be the cheapest alternative you’ve got.

Paying with plastic doesn’t always pay. Getting a loan to cover your moving expenses directly or as a means of consolidating and zeroing out your credit card balances may be worth it. Doing so may ultimately be the cheapest alternative you’ve got.

Reason #3: Your Cash Is Better Off Elsewhere

Even if you have the funds available to cover all those moving expenses, you may not want to. You might be in a situation in which your money is better off left in your investments, because they’re earning more than the cost of financing your loan.

For example, let’s say your investment yields an 11% return and a loan costs you 9%. Your net benefit for leaving your invested money where it is and taking a loan would be 2%.

This could drive you to taking out a moving-expenses loan.

Pro Tip: Use a Loan Calculator to find out how much it’ll cost you to borrow money and what your monthly payments will be.

Reason #4: It May Be the Easiest, Quickest Approach to Paying

Life can be chaotic; moving can up the messy ratio — a lot.

As bizarre or unlikely as it may seem, getting a loan for your moving expenses could actually be the fastest, most straightforward way of pulling together the money required for your move. Think about it like this: Getting a loan could mean:

- Less overall paperwork

- Simpler process than transferring money around from multiple accounts and investments at multiple financial institutions

- Quicker receipt of the money you need

- Fewer moving pieces to your financing approach

- Not having to ask family for assistance

- Ability to afford better moving services, which could reap additional benefits

It’s not sounding like such a wild notion now, is it?

Credit Union Loans for Moving

Now that you’re clear on why taking out a loan for moving costs might be a smart move, let’s look at why working with a credit union — like Valley Credit Union — could make the most sense.

Why Borrow From a Credit Union

Aside from all the general perks that go with joining a credit union, here are some loan-specific reasons to consider a lender like VCU:

- Easier to qualify

- Faster loan application processing

- Lower interest rates and fees

- More flexible terms

- Financial safety nets like Skip a Payment and debt protection

- Convenient banking options

- Personalized service from dedicated and knowledgeable staff

Compared to regular banks, you’ll save yourself time, money, and stress.

Types of Loans for Moving Expenses

Depending upon your situation, you might have an assortment of possible loans available to you.

Mortgages

Did you know that you can use part of your home loan to help cover moving expenses? Yes, it’s true! Ask the helpful staff at Valley Credit Union for details about applying some of the borrowed money towards relocation.

Home Equity Line of Credit (HELOC)

This kind of loan is tied to the equity in your home, but the dollars you’re getting can be put towards anything. A HELOC may offer you favorable, flexible terms that beat other possible financing methods by a mile. VCU home equity lines of credit are very competitive.

Personal Loans

At VCU, we offer a host of personal loans. They really run the gamut in terms of amounts, interest rates, and so on — so that we can right-size the lending to your personal needs. It behooves you to discuss your options with a loan officer!

Loan Application & Approval Process

VCU’s loan application process is uncomplicated and straightforward. In just a few steps, you could be drawing funds from your freshly-minted loan and getting your move on.

Preparing to Apply

Prior to starting the loan process, you’ll want to do some prep work. This will help you power through the loan application in less time and with less hassle.

At VCU, we don’t have set-in-stone qualification criteria to get a loan. We evaluate each applicant’s request and personal situation individually. That said, here are some things we’ll likely use to assess your loan worthiness:

- Amount of available and used credit

- Length and quality of your credit history

- Your employment record

- How long you’ve been a VCU member

Applying

Here’s what you can expect — as a general process — when you apply for a loan at VCU. Of course, the particular type of loan you’re going for may present its own specific nuances.

- Apply online or contact us at (503) 364-7999, option #2.

- Gather your income documents and keep them handy. We may ask to see them.

- VCU will assess your application and contact you with any questions.

- Your loan is pre-approved or a counter offer is made to you.

- Sign all the paperwork to finalize the loan.

- Pay your moving expenses!

Turnaround Time

If you’ve got your paperwork in order, you may be able to close and sign your VCU loan within a day. (It can really be that quick!) Larger or more comlex loans may take longer, but VCU still boasts a relatively rapid review and decision process.

Need Financial Help for Moving? VCU’s Here for You!

Valley Credit Union wants to make moving onwards and upwards in your life as frictionless as possible for you. That’s why we’re here to assist you with your move-related — and other! — financial needs. You’ll find VCU offers many excellent banking and loan products, plenty of services and resources, and superior support from our talented and empathetic team.

Feel free to reach out today. We’re happy to discuss your upcoming move and strategize ways to make it gentler on your wallet. After all, settling in to your new home is a lot easier with financial peace of mind!

About the Author

Justin Roberts, Vice President of Lending

Justin Roberts, Vice President of Lending

Justin Roberts is our Vice President of Lending and has been in the financial industry for over 18 years. He is an Oregon State University Graduate and has just completed Western CUNA Management School. When he is not focused on helping the members at Valley, you will find him coaching his two sons and volunteering his time to help develop the youth in our communities through sports.