Are you interested in having Jeopardy-champ-level knowledge of auto loan interest? We hope so — because having a deep and broad understanding of interest on car loans can save you stress and money.

In this post, we’ll answer frequently asked questions like:

- How does interest work on a car loan?

- How is interest calculated on a car loan?

- When do you pay the interest on a car loan?

Interest on Car Loans — What Is It?

When you can’t or don’t wish to buy your vehicle outright, you’ll need to finance the portion of the cost that you aren’t paying at the time of the purchase. That financing bit — it’s your car loan.

As generous as your auto loan lender may be, it’s probably not going to let you borrow that chunk of money for an extended period of time for free. You pay a premium for the privilege of having access to and use of those funds. That amount you pay to have a loan is the interest, usually expressed as a percentage (aka the interest rate).

It’s a tradeoff — the lender gets to bring home some revenue; you get to bring home a new car.

How Do Car Loan Interest Rates Work?

A lot goes into auto loan rates. It’s partly based on:

- The market. Interest rates fluctuate daily.

- The lender. Different financial institutions offer different rates.

- The loan length. Longer loans typically have higher interest rates than shorter loans.

- The loan amount. Smaller loans may have a higher rate.

- The car. Rates for used cars tend to be higher than those for new cars for the same loan length.

- You. Your creditworthiness will impact the rates. The better your scores, the more favorable rates you’ll probably get.

So, a savvy loan scout will stay tuned to what current average rates are based on factors like the economy and assess their own credit profile. It’s always helpful to discuss your personal financial landscape and financing agenda with a loan specialist — Valley Credit Union is happy to do this.

You can also consider pre-approval for a car loan and — if appropriate — a co-signer.

How Is Interest Calculated On a Car Loan?

Most car loans calculate interest using simple interest, not compound interest. This means you’re paying interest on the value of the still-owed portion of the loan. You’re not paying interest on the interest-owed portion of your loan.

Perhaps the easiest way to illustrate this is through an example. Let’s work these numbers:

- Price of car: $30,000

- Amount of down payment (10%): $3,000

- Remaining amount you need to get a loan for: $27,000

The tables below show the monthly payments and interest/loan costs at different rates and durations.

Loan Amounts by Interest Rate

| Interest Rate |

Terms (Years) |

Monthly Payment |

Total Interest Paid |

Total Cost of Loan |

| 3% |

3 |

$785.19 |

$1,266.94 |

$28,266.94 |

| 3% |

5 |

$485.15 |

$2,109.28 |

$29,109.28 |

| 3% |

7 |

$356.76 |

$2,967.76 |

$29,967.76 |

| 4% |

3 |

$797.15 |

$1,697.31 |

$28,697.31 |

| 4% |

5 |

$497.25 |

$2,834.77 |

$29,834.77 |

| 4% |

7 |

$369.06 |

$4,000.85 |

$31,000.85 |

| 5% |

3 |

$809.21 |

$2,131.71 |

$29,131.71 |

| 5% |

5 |

$509.52 |

$3,571.40 |

$30,571.40 |

| 5% |

7 |

$381.62 |

$5,055.71 |

$32,055.71 |

Loan Amounts by Term

| Interest Rate |

Terms (Years) |

Monthly Payment |

Total Interest Paid |

Total Cost of Loan |

| 3% |

3 |

$785.19 |

$1,266.94 |

$28,266.94 |

| 4% |

3 |

$797.15 |

$1,697.31 |

$28,697.31 |

| 5% |

3 |

$809.21 |

$2,131.71 |

$29,131.71 |

| 3% |

5 |

$485.15 |

$2,109.28 |

$29,109.28 |

| 4% |

5 |

$497.25 |

$2,834.77 |

$29,834.77 |

| 5% |

5 |

$509.52 |

$3,571.40 |

$30,571.40 |

| 3% |

7 |

$356.76 |

$2,967.76 |

$29,967.76 |

| 4% |

7 |

$369.06 |

$4,000.85 |

$31,000.85 |

| 5% |

7 |

$381.62 |

$5,055.71 |

$32,055.71 |

As you can see, at a given rate, a longer-term auto loan will have a lower monthly installment but a bigger overall price tag. And, you can see that the monthly payments, at different rates over a given timeframe, may not be radically different.

Want to see what loan costs might look like for you? We’ll spare you the math — try out our handy Loan Calculator! Be sure to review the View Report tab. It breaks everything down clearly so you can see the progression over time.

Another kind of loan may also be available, a precomputed loan. This less-common loan type calculates the total interest (based on the amount borrowed) and adds it on to the loan value at the start of the loan. That whole sum is then divided by the number of months your loan is for. Precomputed loans have a set amount — that remains the same over the life of the loan — that goes towards interest and principal with each monthly installment.

When Do You Pay Car Loan Interest?

You pay interest throughout the life of your loan. Each monthly payment includes some portion that’s allocated to cover the interest.

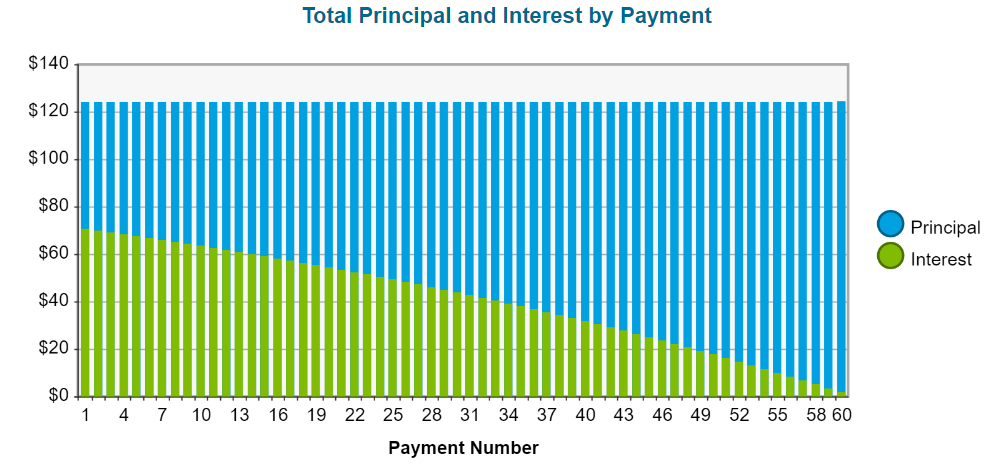

Unless otherwise stated, interest on a car loan is front-loaded. This means that you’re mostly paying down the interest obligation first before you ever start making serious headway on the loan principal.

Every payment you make reduces the balance owed on the principal of the loan to some degree. So you will see the interest portion of each payment diminish over time. Again, refer to that View Report tab on the Loan Calculator for a visualization of this in action. If you look closely, you’ll see the trendline isn’t straight — it bows.

Below is an example, based on a $5,000 loan borrowed at 17% for 5 years. This is an unlikely borrowing scenario, but it shows this curve better than more “realistic” loan numbers (like the ones in the tables above).

There are tactics you can use to chip away at the principal faster or to secure better rates over the course of your loan, though. We go into extreme detail in How to Pay Off Your Car Loan More Quickly. This is good info to have whether you’re still shopping around for a loan or you have a loan and are considering refinancing it.

Because There’s More to Loans than Just Interest

Car loan interest is just one piece of vehicle financing. If you want to take a scenic drive through our knowledge base, we recommend making pit stops with these articles:

Credit Union Vehicle Financing — Lowest Rates & More!

The list of reasons you should finance your car through a credit union is long and substantial. You’ll come away from the negotiating table with more than just a water bottle with the bank’s logo on it (or some other insignificant branded merch).

When getting your loan from a CU, you’ll likely get much better interest rates than you’d get from a conventional retail bank. For example, here are some other things members love about financing their car with Valley Credit Union:

- Lower rates (reiterating this because it’s so noteworthy!)

- Quicker, easier application and approval processes

- Better, more flexible terms

- Fewer and lower fees

- Loads of tools and resources for research and payment

- Unique perks like Auto Consulting

- Better support and service

For even deeper looks at the pros of credit union vehicle financing, check out Why a Credit Union May Have Better Car Loan Rates than a Dealer and Why You Should Get Your Auto Loan From a Credit Union.

Working with VCU…It’s in Your Best Interest

Our caring team is invested in your financial well-being. We’ll go out of our way to help you get the right auto loan for your situation. It’s our pleasure to guide you throughout the process and answer any questions you have.

In fact, it’s this dedication and knowledge that keep members coming back for all their banking needs. We look forward to serving you the next time you’re on the market for a vehicle loan — or mortgage or home line of credit, checking or savings account, and more!

We really want to drive this point home (like you and that fine new coupe you’re eyeing), feel free to reach out any time if we can be of assistance.

About the Author

Justin Roberts, Vice President of Lending

Justin Roberts, Vice President of Lending

Justin Roberts is our Vice President of Lending and has been in the financial industry for over 18 years. He is an Oregon State University Graduate and has just completed Western CUNA Management School. When he is not focused on helping the members at Valley, you will find him coaching his two sons and volunteering his time to help develop the youth in our communities through sports.